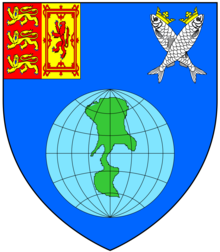

Кронштейны Южного моря компании: Azure, земной шар на котором изображены Магелланов пролив и мыс Горн все собственно и в зловещей главный момент два сельдь haurient в Saltire серебристость венценосный или, в кантоне в единые руки Великобритании | |

| Тип | Общественные |

|---|---|

| Промышленность | Работорговля |

| Основан | Январь 1711 |

| Несуществующий | 1853 г. |

| Штаб-квартира | , Великобритания |

Компания Южных морей (официально Губернатор и Компания купцов Великобритании, торгующих в Южных морях и других частях Америки и для поощрения рыболовства ) [3] была британской акционерной компанией, основанной в январе 1711 года. , созданный как государственно-частное партнерство для консолидации и снижения стоимости государственного долга . Для получения дохода в 1713 году компании была предоставлена монополия ( Asiento de Negros ) на поставку африканских рабов на острова в « Южных морях » и в Южной Америке . [4]Когда была создана компания, Великобритания была вовлечена в Войну за испанское наследство, а Испания и Португалия контролировали большую часть Южной Америки. Таким образом, не было реальной перспективы, что торговля состоится, и, как выяснилось, Компания так и не получила значительной прибыли от своей монополии. Тем не менее, акции компании значительно выросли в цене , как она расширила свои операции , касающиеся государственного долга, и достигла своего пика в 1720 году , прежде чем внезапно рушится , чтобы немного выше своей первоначальной флотационной цене. Созданный таким образом пресловутый экономический пузырь , разоривший тысячи инвесторов, стал известен как пузырь Южного моря .

Bubble Act 1720 ( 6 Geo I , с 18 лет), который запрещал создание акционерных обществ без королевского устава , был продвинут на Южном море самой компании до ее распада.

В Великобритании многие инвесторы были разорены падением цен на акции, и в результате национальная экономика существенно упала. Основатели схемы занимались инсайдерской торговлей , используя свои предварительные знания о сроках консолидации государственного долга, чтобы получить большую прибыль от покупки долга заранее. Политическим деятелям давали огромные взятки за поддержку законодательных актов, необходимых для этой схемы. [5]Деньги компании использовались для совершения сделок с ее собственными акциями, а отдельным лицам, покупавшим акции, были предоставлены денежные ссуды, обеспеченные этими же акциями, на покупку дополнительных акций. Ожидание прибылей от торговли с Южной Америкой было рассмотрено, чтобы побудить общественность покупать акции, но пузырчатые цены вышли далеко за пределы того, что могла оправдать фактическая прибыль бизнеса (а именно работорговля). [6]

После того, как пузырь лопнул, было проведено парламентское расследование для выяснения его причин. Ряд политиков были опозорены, а у людей, получивших безнравственную прибыль от компании, конфисковали личные активы пропорционально их доходам (большинство из них уже были богатыми и остались такими). Наконец, компания была реструктурирована и продолжала работать более века после пузыря. Штаб-квартира находилась на Треднидл-стрит , в центре лондонского Сити , финансового района столицы. Во время этих событий Банк Англии также был частной компанией, занимающейся государственным долгом, и крах его конкурента подтвердил его позицию банкира для британского правительства. [7]

Фонд [ править ]

Когда в августе 1710 года Роберт Харли был назначен канцлером казначейства , правительство уже стало полагаться на Банк Англии , частную компанию, зарегистрированную 16 лет назад и получившую монополию в качестве кредитора Вестминстера, [ необходимы разъяснения ] в возврат за организацию и управление ссудами государству. Правительство стало недовольно услугами, которые оно получало, и Харли активно искал новые способы улучшить состояние национальных финансов.

Новый парламент собрался в ноябре 1710 года, решив заняться делами национальных финансов, которые страдали от давления двух одновременных войн : войны за испанское наследство с Францией, которая закончилась в 1713 году, и Великой Северной войны , которая не должна была закончиться. до 1721 года. Харли прибыл подготовленным, с подробными отчетами, описывающими ситуацию с государственным долгом, который, как правило, представлял собой частичную договоренность, при которой каждое правительственное ведомство брало займы независимо по мере необходимости. Он постоянно публиковал информацию, постоянно добавляя новые отчеты о возникших долгах и скандальных расходах, пока в январе 1711 года Палата общин не согласилась назначить комитет для расследования всего долга. В комитет входил сам Харли, двоеАудиторы аван- (чья задача состояла в том, чтобы исследовать государственные расходы), Эдвард Харли (брат канцлера), Пол Фоли (шурин канцлера), то секретарь казначейства , Уильям Лоундс (который имел значительную ответственность за reminting вся обесцененная британская чеканка в 1696 году) и Джон Эйслаби (представлявший Октябрьский клуб , группу из примерно 200 депутатов, согласившихся голосовать вместе). [8]

Первой заботой Харли было найти 300 000 фунтов стерлингов для выплаты в следующем квартале британской армии, действующей на континенте под командованием герцога Мальборо . Это финансирование было предоставлено частным консорциумом Эдуарда Гиббона, дед историка , Джордж Касуолл и Банка Хоара . Банк Англии проводил государственную лотерею от имени правительства, но в 1710 году она принесла меньше доходов, чем ожидалось, а другая, начатая в 1711 году, также показала плохие результаты; Харли предоставил право продавать билеты Джону Бланту , директору компании Hollow Sword Blade., который, несмотря на свое название, был неофициальным банком. Продажи начались 3 марта 1711 года, а к 7-му билеты были полностью распроданы, что сделало лотерею первой по-настоящему успешной английской государственной лотереей. [9]

Вскоре за успехом последовала еще одна более крупная лотерея, «Два миллиона приключений» или «The Classis», билеты на которую стоили 100 фунтов стерлингов, главный приз - 20 000 фунтов стерлингов, и каждый билет выигрывал не менее 10 фунтов стерлингов. Хотя призы рекламировались по их общей стоимости, на самом деле они выплачивались частями в виде фиксированной ренты в течение нескольких лет, так что правительство фактически удерживало призовые деньги в качестве займов до тех пор, пока вся сумма не была выплачена в пользу компании. победители. Маркетингом занимались члены синдиката Sword Blade: Гиббон продавал билеты на 200 000 фунтов стерлингов и получил комиссионные в размере 4500 фунтов стерлингов, а Блант продавал 993 000 фунтов стерлингов. Чарльз Блант (родственник) был назначен казначеем лотереи с расходами в 5000 фунтов стерлингов.

Концепция компании [ править ]

В ходе расследования государственного долга был сделан вывод о том, что государство задолжало в общей сложности 9 миллионов фунтов стерлингов, без какого-либо специально выделенного дохода для его погашения. Эдвард Харли и Джон Блант совместно разработали схему консолидации этого долга во многом так же, как Банк Англии консолидировал предыдущие долги, хотя Банк по-прежнему имел монополию на деятельность в качестве банка. Все держатели долга (кредиторы) должны будут передать его новой компании, созданной для этой цели, компании Южного моря, которая взамен выпустит им собственные акции той же номинальной стоимости. Правительство будет производить ежегодный платеж Компании в размере 568 279 фунтов стерлингов, что соответствует 6% процентов плюс расходы, которые затем будут перераспределены между акционерами в качестве дивидендов. Компании также была предоставлена монополия на торговлю с Южной Америкой.потенциально прибыльное предприятие, но контролируемое Испанией, с которой Великобритания находилась в состоянии войны.[10]

В то время, когда континент Америка исследовался и колонизировался, европейцы применяли термин «Южные моря» только к Южной Америке и окружающим ее водам. Уступка одновременно открывала потенциал для будущих прибылей и поощряла стремление к прекращению войны, необходимое для получения какой-либо прибыли. Первоначальное предложение по схеме Южного моря исходило от Уильяма Патерсона , одного из основателей Банка Англии и финансово катастрофической схемы Дариена . [10]

Харли был награжден за реализацию плана, став графом Оксфордским 23 мая 1711 года и назначен лордом-верховным казначеем . Заняв более безопасное положение, он начал секретные мирные переговоры с Францией.

Первоначальные предположения [ править ]

Схема, направленная на консолидацию всего государственного долга и более эффективное управление им в будущем, предусматривала возможность выплаты всем существующим кредиторам полной номинальной стоимости своих займов, которые на момент публикации схемы оценивались по дисконтированной ставке в размере 55 фунтов стерлингов за 100 фунтов стерлингов номинальной стоимости, так как лотереи были дискредитированы, а способность правительства выплатить полную сумму была под сомнением. Таким образом, облигации, представляющие долг, предназначенный для консолидации по схеме, были доступны для покупки на открытом рынке по цене, которая позволяла любому, кто заранее знал, покупать и перепродавать в ближайшем будущем с высокой прибылью, поскольку, как только схема стала известна облигации снова будут стоить, по крайней мере, их номинальной стоимости, поскольку перспектива погашения теперь более определена.Это ожидание выгоды позволило Харли привлечь к схеме дополнительных финансовых сторонников, таких как Джеймс Бейтман иTheodore Janssen.[11]

Daniel Defoe commented:[12]

- Unless the Spaniards are to be divested of common sense, infatuate, and given up, abandoning their own commerce, throwing away the only valuable stake they have left in the world, and in short, bent on their own ruin, we cannot suggest that they will ever, on any consideration, or for any equivalent, part with so valuable, indeed so inestimable a jewel, as the exclusive trade to their own plantations.

The originators of the scheme knew that there was no money to invest in a trading venture, and no realistic expectation that there would ever be a trade to exploit, but nevertheless the potential for great wealth was widely publicised at every opportunity, so as to encourage interest in the scheme. The objective for the founders was to create a company that they could use to become wealthy and that offered scope for further government deals.[13]

Flotation[edit]

The royal charter for the company, based on that of the Bank of England, was drawn up by Blunt who was paid £3,846 for his services in setting up the company. Directors would be elected every three years and shareholders would meet twice a year. The Company employed a Cashier, Secretary and Accountant. The Governor was intended as an honorary position, and was later customarily held by the monarch. The charter allowed the full court of directors to nominate a smaller committee to act on any matter on its behalf. Directors of the Bank of England and of the East India Company were barred from being directors of the South Sea Company. Any ship of more than 500 tons owned by the Company was to have a Church of England clergyman on board.

The surrender of government debt for Company stock was to occur in five separate lots. The first two of these, totaling £2.75 million from about 200 large investors, had already been arranged before the company's charter was issued on 10 September 1711. The government itself surrendered £0.75 million of its own debt held by different departments (at that time individual office holders were at liberty to invest government funds under their control to their own advantage before it was required for government expenditure). Harley surrendered £8,000 of debt and was appointed Governor of the new company. Blunt, Caswall and Sawbridge together surrendered £65,000, Janssen £25,000 of his own plus £250,000 from a foreign consortium, Decker £49,000, Sir Ambrose Crawley £36,791. The company had a Sub-Governor, Bateman; a Deputy Governor, Ongley; and 30 ordinary directors. In total, nine of the directors were politicians, five were members of the Sword Blade consortium, and seven more were financial magnates who had been attracted to the scheme.[14]

The company created a coat of arms with the motto A Gadibus usque ad Auroram ("from Cadiz to the dawn", from Juvenal, Satires, 10) and rented a large house in the City of London as its headquarters. Seven sub-committees were created to handle its everyday business, the most important being the "committee for the affairs of the company". The Sword Blade company was retained as the Company's banker and on the strength of its new government connections issued notes in its own right, notwithstanding the Bank of England's monopoly. The task of the Company Secretary was to oversee trading activities; the Accountant, Grigsby, was responsible for registering and issuing stock; and the Cashier, Robert Knight, acted as Blunt's personal assistant at a salary of £200 per annum.[15]

The slave trade[edit]

The Treaty of Utrecht of 1713 granted Britain an Asiento de Negros lasting 30 years to supply the Spanish colonies with 4,800 slaves per year. Britain was permitted to open offices in Buenos Aires, Caracas, Cartagena, Havana, Panama, Portobello and Vera Cruz to arrange the Atlantic slave trade. One ship of no more than 500 tons could be sent to one of these places each year (the Navío de Permiso) with general trade goods. One quarter of the profits were to be reserved for the King of Spain. There was provision for two extra sailings at the start of the contract. The Asiento was granted in the name of Queen Anne and then contracted to the company.[16]

By July the company had arranged contracts with the Royal African Company to supply the necessary African slaves to Jamaica. Ten pounds was paid for a slave aged over 16, £8 for one under 16 but over 10. Two-thirds were to be male, and 90% adult. The company trans-shipped 1,230 slaves from Jamaica to America in the first year, plus any that might have been added (against standing instructions) by the ship's captains on their own behalf. On arrival of the first cargoes, the local authorities refused to accept the Asiento, which had still not been officially confirmed there by the Spanish authorities. The slaves were eventually sold at a loss in the West Indies.[17]

In 1714 the government announced that a quarter of profits would be reserved for Queen Anne and a further 7.5% for a financial adviser, Manasseh Gilligan. Some Company board members refused to accept the contract on these terms, and the government was obliged to reverse its decision.[18]

Despite these setbacks, the company continued, having raised £200,000 to finance the operations. In 1714 2,680 slaves were carried, and for 1716–17, 13,000 more, but the trade continued to be unprofitable. An import duty of 33 pieces of eight was charged on each slave (although for this purpose some slaves might be counted only as a fraction of a slave, depending on quality). One of the extra trade ships was sent to Cartagena in 1714 carrying woollen goods, despite warnings that there was no market for them there, and they remained unsold for two years.[19]

It has been estimated that the company transported a little over 34,000 slaves with mortality losses comparable to its competitors, showing that slave trading was a significant part of the company's work, and that it was carried out to the standards of the day.[4] Its trading activities therefore offered a financial motivation for investment in the company.[4]

Changes of management[edit]

The company was heavily dependent on the goodwill of government; when the government changed, so too did the company board. In 1714 one of the directors who had been sponsored by Harley, Arthur Moore, had attempted to send 60 tons of private goods on board the company ship. He was dismissed as a director, but the result was the beginning of Harley's fall from favour with the company. On 27 July 1714, Harley was replaced as Lord High Treasurer as a result of a disagreement that had broken out within the Tory faction in parliament. Queen Anne died on 1 August 1714; and at the election of directors in 1715 the Prince of Wales (the future King George II) was elected as Governor of the Company. The new King George I and the Prince of Wales both had large holdings in the company, as did some prominent Whig politicians, including James Craggs the Elder, the Earl of Halifax and Sir Joseph Jekyll. James Craggs, as Postmaster General, was responsible for intercepting mail on behalf of the government to obtain political and financial information. All Tory politicians were removed from the board and replaced with businessmen. The Whigs Horatio Townshend, brother in law of Robert Walpole, and the Duke of Argyll were elected directors.

The change of government led to a revival of the company's share value, which had fallen below its issue price. The previous government had failed to make the interest payments to the company for the preceding two years, owing more than £1 million. The new administration insisted that the debt be written off, but allowed the company to issue new shares to stockholders to the value of the missed payments. At around £10 million, this now represented half the share capital issued in the entire country. In 1714 the company had 2,000 to 3,000 shareholders, more than either of its rivals.[20]

By the time of the next directors' elections in 1718 politics had changed again, with a schism within the Whigs between Walpole's faction supporting the Prince of Wales and James Stanhope's supporting the King. Argyll and Townshend were dismissed as directors, as were surviving Tories Sir Richard Hoare and George Pitt, and King George I became governor. Four MPs remained directors, as did six people holding government financial offices. The Sword Blade Company remained bankers to the South Sea, and indeed had flourished despite the company's dubious legal position. Blunt and Sawbridge remained South Sea directors, and they had been joined by Gibbon and Child. Caswall had retired as a South Sea director to concentrate on the Sword Blade business. In November 1718 Sub-Governor Bateman and Deputy Governor Shepheard both died. Leaving aside the honorary position of Governor, this left the company suddenly without its two most senior and experienced directors. They were replaced by Sir John Fellowes as Sub-Governor and Charles Joye as Deputy.[21]

War[edit]

In 1718 war broke out with Spain once again, in the War of the Quadruple Alliance. The company's assets in South America were seized, at a cost claimed by the company to be £300,000. Any prospect of profit from trade, for which the company had purchased ships and had been planning its next ventures, disappeared.[22]

Refinancing government debt[edit]

Events in France now came to influence the future of the company. A Scottish economist and financier, John Law, exiled after killing a man in a duel, had travelled around Europe before settling in France. There he founded a bank, which in December 1718 became the Banque Royale, national bank of France, while Law himself was granted sweeping powers to control the economy of France, which operated largely by royal decree. Law's remarkable success was known in financial circles throughout Europe, and now came to inspire Blunt and his associates to make greater efforts to grow their own concerns.[23]

In February 1719 Craggs explained to the House of Commons a new scheme for improving the national debt by converting the annuities issued after the 1710 lottery into South Sea stock. By Act of Parliament, the company was granted the right to issue £1,150 of new stock for every £100 per annum of annuity which was surrendered. The government would pay 5% per annum on the stock created, which would halve their annual bill. The conversion was voluntary, amounting to £2.5 million new stock if all converted. The company was to make an additional new loan to the government pro rata up to £750,000, again at 5%.[24]

In March there was an abortive attempt to restore the Old Pretender, James Edward Stuart, to the throne of Britain, with a small landing of troops in Scotland. They were defeated at the Battle of Glen Shiel on 10 June. The South Sea company presented the offer to the public in July 1719. The Sword Blade company spread a rumour that the Pretender had been captured, and the general euphoria induced the South Sea share price to rise from £100, where it had been in the spring, to £114. Annuitants were still paid out at the same money value of shares, the company keeping the profit from the rise in value before issuing. About two-thirds of the in-force annuities were exchanged.

Trading more debt for equity[edit]

The 1719 scheme was a distinct success from the government's perspective, and they sought to repeat it. Negotiations took place between Aislabie and Craggs for the government and Blunt, Cashier Knight and his assistant and Caswell. Janssen, the Sub Governor and Deputy Governor were also consulted but negotiations remained secret from most of the company. News from France was of fortunes being made investing in Law's bank, whose shares had risen sharply. Money was moving around Europe, and other flotations threatened to soak up available capital (two insurance schemes in December 1719 each sought to raise £3 million).[25]

Plans were made for a new scheme to take over most of the unconsolidated national debt of Britain (£30,981,712) in exchange for company shares. Annuities were valued as a lump sum necessary to produce the annual income over the original term at an assumed interest of 5%, which favoured those with shorter terms still to run. The government agreed to pay the same amount to the company for all the fixed-term repayable debt as it had been paying before, but after seven years the 5% interest rate would fall to 4% on both the new annuity debt and also that assumed previously. After the first year, the company was to give the government £3 million in four quarterly installments. New stock would be created at a face value equal to the debt, but the share price was still rising and sales of the remaining stock, i.e. the excess of the total market value of the stock over the amount of the debt, would be used to raise the government fee plus a profit for the company. The more the price rose in advance of conversion, the more the company would make. Before the scheme, payments were costing the government £1.5 million per year.[26]

In summary, the total government debt in 1719 was £50 million:

- £18.3m was held by three large corporations:

- £3.4m by the Bank of England

- £3.2m by the British East India Company

- £11.7m by the South Sea Company

- Privately held redeemable debt amounted to £16.5m

- £15m consisted of irredeemable annuities, long-fixed-term annuities of 72–87 years, and short annuities of 22 years remaining to expiry.

The purpose of this conversion was similar to the old one: debt holders and annuitants might receive less return in total, but an illiquid investment was transformed into shares that could be readily traded. Shares backed by national debt were considered a safe investment and a convenient way to hold and move money, far easier and safer than metal coins. The only alternative safe asset, land, was much harder to sell and transfer of its ownership was legally much more complex.

The government received a cash payment and lower overall interest on the debt. Importantly, it also gained control over when the debt had to be repaid, which was not before seven years but then at its discretion. This avoided the risk that debt might become repayable at some future point just when the government needed to borrow more, and could be forced into paying higher interest rates. The payment to the government was to be used to buy in any debt not subscribed to the scheme, which although it helped the government also helped the company by removing possibly competing securities from the market, including large holdings by the Bank of England.[26]

Company stock was now trading at £123, so the issue amounted to an injection of £5 million of new money into a booming economy just as interest rates were falling. Gross Domestic Product (GDP) for Britain at this point was estimated as £64.4 million.[27]

Public announcement[edit]

On 21 January the plan was presented to the board of the South Sea Company, and on 22 January Chancellor of the Exchequer John Aislabie presented it to Parliament. The House was stunned into silence, but on recovering proposed that the Bank of England should be invited to make a better offer. In response, the South Sea increased its cash payment to £3.5 million, while the Bank proposed to undertake the conversion with a payment of £5.5 million and a fixed conversion price of £170 per £100 face value Bank stock. On 1 February, the company negotiators led by Blunt raised their offer to £4 million plus a proportion of £3.5 million depending on how much of the debt was converted. They also agreed that the interest rate would decrease after four years instead of seven, and agreed to sell on behalf of the government £1 million of Exchequer bills (formerly handled by the Bank). The House accepted the South Sea offer. Bank stock fell sharply.[28]

Perhaps the first sign of difficulty came when the South Sea Company announced that its Christmas 1719 dividend would be deferred for 12 months. The company now embarked on a show of gratitude to its friends. Select individuals were sold a parcel of company stock at the current price. The transactions were recorded by Knight in the names of intermediaries, but no payments were received and no stock issued – indeed the company had none to issue until the conversion of debt began. The individual received an option to sell his stock back to the company at any future date at whatever market price might then apply. Shares went to the Craggs: the Elder and the Younger; Lord Gower; Lord Lansdowne; and four other MPs. Lord Sunderland would gain £500 for every pound that stock rose; George I's mistress, their children and Countess Platen £120 per pound rise, Aislabie £200 per pound, Lord Stanhope £600 per pound. Others invested money, including the Treasurer to the Navy, Hampden, who invested £25,000 of government money on his own behalf.[29]

The proposal was accepted in a slightly altered form in April 1720. Crucial in this conversion was the proportion of holders of irredeemable annuities who could be tempted to convert their securities at a high price for the new shares. (Holders of redeemable debt had effectively no other choice but to subscribe.) The South Sea Company could set the conversion price but could not diverge much from the market price of its shares. The company ultimately acquired 85% of the redeemables and 80% of the irredeemables.

[edit]

The company then set to talking up its stock with "the most extravagant rumours" of the value of its potential trade in the New World; this was followed by a wave of "speculating frenzy". The share price had risen from the time the scheme was proposed: from £128 in January 1720, to £175 in February, £330 in March and, following the scheme's acceptance, £550 at the end of May.[30]

What may have supported the company's high multiples (its P/E ratio) was a fund of credit (known to the market) of £70 million available for commercial expansion which had been made available through substantial support, apparently, by Parliament and the King.[31]

Shares in the company were "sold" to politicians at the current market price; however, rather than paying for the shares, these recipients simply held on to what shares they had been offered, with the option of selling them back to the company when and as they chose, receiving as "profit" the increase in market price. This method, while winning over the heads of government, the King's mistress, et al., also had the advantage of binding their interests to the interests of the Company: in order to secure their own profits, they had to help drive up the stock. Meanwhile, by publicising the names of their elite stockholders, the Company managed to clothe itself in an aura of legitimacy, which attracted and kept other buyers.[32]

Bubble Act[edit]

The South Sea Company was by no means the only company seeking to raise money from investors in 1720. A large number of other joint-stock companies had been created making extravagant (sometimes fraudulent) claims about foreign or other ventures or bizarre schemes. Others represented potentially sound, although novel, schemes, such as for founding insurance companies. These were nicknamed "Bubbles". Some of the companies had no legal basis, while others, such as the Hollow Sword Blade company acting as the South Sea's banker, used existing chartered companies for purposes entirely different from their creation. The York Buildings Company was set up to provide water to London, but was purchased by Case Billingsley who used it to purchase confiscated Jacobite estates in Scotland, which then formed the assets of an insurance company.[33]

On 22 February 1720 John Hungerford raised the question of bubble companies in the House of Commons, and persuaded the House to set up a committee, which he chaired, to investigate. He identified a number of companies which between them sought to raise £40 million in capital. The committee investigated the companies, establishing a principle that companies should not be operating outside the objects specified in their charters. A potential embarrassment for the South Sea was avoided when the question of the Hollow Sword Blade Company arose. Difficulty was avoided by flooding the committee with MPs who were supporters of the South Sea, and voting down by 75 to 25 the proposal to investigate the Hollow Sword. (At this time, committees of the House were either 'Open' or 'secret'. A secret committee was one with a fixed set of members who could vote on its proceedings. By contrast, any MP could join in with an 'open' committee and vote on its proceedings.) Stanhope, who was a member of the committee, received £50,000 of the 'resaleable' South Sea stock from Sawbridge, a director of the Hollow Sword, at about this time. Hungerford had previously been expelled from the Commons for accepting a bribe.[33]

Amongst the bubble companies investigated were two supported by Lords Onslow and Chetwynd respectively, for insuring shipping. These were criticised heavily, and the questionable dealings of the Attorney-General and Solicitor-General in trying to obtain charters for the companies led to both being replaced. However, the schemes had the support of Walpole and Craggs, so that the larger part of the Bubble Act (which finally resulted in June 1720 from the committee's investigations) was devoted to creating charters for the Royal Exchange Assurance Corporation and the London Assurance Corporation. The companies were required to pay £300,000 for the privilege. The Act required that a joint stock company could be incorporated only by Act of Parliament or Royal charter. The prohibition on unauthorised joint stock ventures was not repealed until 1825.[34]

The passing of the Act gave a boost to the South Sea Company, its shares leaping to £890 in early June. This peak encouraged people to start to sell; to counterbalance this the company's directors ordered their agents to buy, which succeeded in propping the price up at around £750.

Top reached[edit]

The price of the stock went up over the course of a single year from about £100 to almost £1000 per share. Its success caused a country-wide frenzy—herd behavior[35]—as all types of people, from peasants to lords, developed a feverish interest in investing: in South Seas primarily, but in stocks generally. One famous apocryphal story is of a company that went public in 1720 as "a company for carrying out an undertaking of great advantage, but nobody to know what it is".[36]

The price finally reached £1,000 in early August 1720, and the level of selling was such that the price started to fall, dropping back to £100 per share before the year was out.[37] This triggered bankruptcies amongst those who had bought on credit, and increased selling, even short selling[citation needed] (i.e., selling borrowed shares in the hope of buying them back at a profit if the price fell).

Also, in August 1720, the first of the installment payments of the first and second money subscriptions on new issues of South Sea stock were due. Earlier in the year John Blunt had come up with an idea to prop up the share price: the company would lend people money to buy its shares. As a result, many shareholders could not pay for their shares except by selling them.[citation needed]

Furthermore, a scramble for liquidity appeared internationally as "bubbles" were also ending in Amsterdam and Paris. The collapse coincided with the fall of the Mississippi Company of John Law in France. As a result, the price of South Sea shares began to decline.[citation needed]

Recriminations[edit]

By the end of September the stock had fallen to £150. Company failures now extended to banks and goldsmiths, as they could not collect loans made on the stock, and thousands of individuals were ruined, including many members of the aristocracy. With investors outraged, Parliament was recalled in December and an investigation began. Reporting in 1721, it revealed widespread fraud amongst the company directors and corruption in the Cabinet. Among those implicated were John Aislabie (the Chancellor of the Exchequer), James Craggs the Elder (the Postmaster General), James Craggs the Younger (the Southern Secretary), and even Lord Stanhope and Lord Sunderland (the heads of the Ministry). Craggs the Elder and Craggs the Younger both died in disgrace; the remainder were impeached for their corruption. The Commons found Aislabie guilty of the "most notorious, dangerous and infamous corruption", and he was imprisoned.

The newly appointed First Lord of the Treasury, Robert Walpole, successfully restored public confidence in the financial system. However, public opinion, as shaped by the many prominent men who lost money, demanded revenge. Walpole supervised the process, which removed all 33 of the company directors and stripped them of, on average, 82% of their wealth. The money went to the victims and the stock of the South Sea Company was divided between the Bank of England and the East India Company. Walpole made sure that King George and his mistresses were protected, and by a margin of three votes he managed to save several key government officials from impeachment. In the process, Walpole won plaudits as the savior of the financial system while establishing himself as the dominant figure in British politics; historians credit him for rescuing the Whig government, and indeed the Hanoverian Dynasty, from total disgrace.[38][39][40]

Quotations prompted by the collapse[edit]

Joseph Spence wrote that Lord Radnor reported to him "When Sir Isaac Newton was asked about the continuance of the rising of South Sea stock... He answered 'that he could not calculate the madness of people'."[41] He is also quoted as stating, "I can calculate the movement of the stars, but not the madness of men".[42] Newton himself owned nearly £22,000 in South Sea stock in 1722, but it is not known how much he lost, if anything.[43] There are, however, numerous sources stating he lost up to £20,000 which would equate to over $3,000,000 adjusted for U.S. currency in 2003. [44]

A trading company[edit]

The South Sea Company was created in 1711 to reduce the size of public debts, but was granted the commercial privilege of exclusive rights of trade to the Spanish Indies, based on the treaty of commerce signed by Britain and the Archduke Charles, candidate to the Spanish throne during the War of the Spanish Succession. After Philip V became the King of Spain, Britain obtained at the 1713 Treaty of Utrecht the rights to the slave trade to the Spanish Indies (or Asiento de Negros) for 30 years. Those rights were previously held by the Compagnie de Guinée et de l'Assiente du Royaume de la France.

The South Sea Company board opposed taking on the slave trade, which had showed little profitability when chartered companies had engaged in it, but it was the only legal type of commerce with the Spanish Colonies as they were a closed market[clarification needed]. To increase the profitability, the Asiento contract included the right to send one yearly 500-ton ship to the fairs at Portobello and Veracruz loaded with duty-free merchandises, called the Navío de Permiso. The Crown of England and the King of Spain were each entitled to 25% of the profits, according to the terms of the contract, that was a copy of the French Asiento contract, but Queen Anne soon renounced her share. The King of Spain did not receive any payments due to him, and this was one of the sources of contention between the Spanish Crown and the South Sea Company.

As was the case for previous holders of the Asiento, the Portuguese and the French, the profit was not in the slave trade but in the illegal contraband goods smuggled in the slave ships and in the annual ship. Those goods were sold at the Spanish colonies at a handsome price as they were in high demand and constituted unfair competition with taxed goods, proving a large drain on the Spanish Crown trade income. The relationship between the South Sea Company and the Government of Spain was always bad, and worsened with time. The Company complained of searches and seizures of goods, lack of profitability, and confiscation of properties during the wars between Britain and Spain of 1718–1723 and 1727–1729, during which the operations of the Company were suspended. The Government of Spain complained of the illegal trade, failure of the company to present its accounts as stipulated by the contract, and non-payment of the King's share of the profits. These claims were a major cause of deteriorating relations between the two countries in 1738; and although the Prime Minister Walpole opposed war, there was strong support for it from the King, the House of Commons, and a faction in his own Cabinet. Walpole was able to negotiate a treaty with the King of Spain at the Convention of Pardo in January 1739 that stipulated that Spain would pay British merchants £95,000 in compensation for captures and seized goods, while the South Sea Company would pay the Spanish Crown £68,000 in due proceeds from the Asiento. The South Sea Company refused to pay those proceeds and the King of Spain retained payment of the compensation until payment from the South Sea Company could be secured. The breakup of relations between the South Sea Company and the Spanish Government was a prelude to the Guerra del Asiento, as the first Royal Navy fleets departed in July 1739 for the Caribbean, prior to the declaration of war, which lasted from October 1739 until 1748. This war is known as the War of Jenkins' Ear.[45][46][47]

Slave trade under the Asiento[edit]

Under the Treaty of Tordesillas, Spain was the only European power that could not establish factories in Africa to purchase slaves. The slaves for the Spanish America were provided by companies that were granted exclusive rights to their trade. This monopoly contract was called the slave Asiento. Between 1701 and 1713 the Asiento contract was granted to France. In 1711 Britain had created the South Sea Company to reduce debt and to trade with the Spanish America, but that commerce was illegal without a permit from Spain, and the only existing permit was the Asiento for the slave trade, so at the Treaty of Utrecht in 1713 Britain obtained the transfer of the Asiento contract from French to British hands for the next 30 years. The board of directors was reluctant to take on the slave trade, which was not an object of the company and had shown little profitability when carried out by chartered companies, but they finally agreed on 26 March 1714. The Asiento set a sale quota of 4800 units of slaves per year. An adult male slave counted as one unit; females and children counted as fractions of a unit. Initially the slaves were provided by the Royal African Company.

The South Sea Company established slave reception factories at Cartagena, Colombia, Veracruz, Mexico, Panama, Portobello, La Guaira, Buenos Aires, La Havana and Santiago de Cuba, and slave deposits at Jamaica and Barbados. Despite problems with speculation, the South Sea Company was relatively successful at slave trading and meeting its quota (it was unusual for other, similarly chartered companies to fulfill their quotas). According to records compiled by David Eltis and others, during the course of 96 voyages in 25 years, the South Sea Company purchased 34,000 slaves, of whom 30,000 survived the voyage across the Atlantic.[48] (Thus about 11% of the slaves died on the voyage: a relatively low mortality rate for the Middle Crossing.[49]) The company persisted with the slave trade through two wars with Spain and the calamitous 1720 commercial bubble. The company's trade in human slavery peaked during the 1725 trading year, five years after the bubble burst.[50] Between 1715 and 1739, slave trading constituted the main legal commercial activity of the South Sea Company.[citation needed]

The annual ship[edit]

The slave Asiento contract of 1713 granted a permit to send one vessel of 500 tons per year, loaded with duty-free merchandise to be sold at the fairs of New Spain, Cartagena, and Portobello. This was an unprecedented concession that broke two centuries of strict exclusion of foreign merchants from the Spanish Empire.[51]

The first ship to head for the Americas, the Royal Prince, was scheduled for 1714 but was delayed until August 1716. In consideration of the three annual ships missed since the date of the Asiento, the permitted tonnage of the next ten ships was raised to 650.[52] Actually only seven annual ships sailed during the Asiento, the last one being the Royal Caroline in 1732. The company's failure to produce accounts for all the annual ships but the first one, and lack of payment of the proceeds to the Spanish Crown from the profits for all the annual ships, resulted in no more permits being granted to the Company's ships after the Royal Caroline trip of 1732–1734.

In contrast to the "legitimate" trade in slaves, the regular trade of the annual ships generated healthy returns, in some case profits were over 100%.[53] Accounts for the voyage of the Royal Prince were not presented until 1733, following continuous demands by Spanish officials. They reported that profits of £43,607.[54] Since the King of Spain was entitled to 25% of the profits, after deducting interest on a loan he claimed £8,678. The South Sea Company never paid the amount due for the first annual ship to the Spanish Crown, nor did it pay any amount for any of the other six trips.[citation needed]

Arctic whaling[edit]

The Greenland Company had been established by Act of Parliament in 1693 with the object of catching whales in the Arctic. The products of their "whale-fishery" were to be free of customs and other duties. Partly due to maritime disruption caused by wars with France, the Greenland Company failed financially within a few years. In 1722 Henry Elking published a proposal, directed at the governors of the South Sea Company, that they should resume the "Greenland Trade" and send ships to catch whales in the Arctic. He made very detailed suggestions about how the ships should be crewed and equipped.[55]

The British Parliament confirmed that a British Arctic "whale-fishery" would continue to benefit from freedom from customs duties, and in 1724 the South Sea Company decided to commence whaling. They had 12 whale-ships built on the River Thames and these went to the Greenland seas in 1725. Further ships were built in later years, but the venture was not successful. There were hardly any experienced whalemen remaining in Britain, and the Company had to engage Dutch and Danish whalemen for the key posts aboard their ships: for instance all commanding officers and harpooners were hired from the North Frisian island of Föhr.[56] Other costs were badly controlled and the catches remained disappointingly few, even though the Company was sending up to 25 ships to Davis Strait and the Greenland seas in some years. By 1732 the Company had accumulated a net loss of £177,782 from their eight years of Arctic whaling.[57]

The South Sea Company directors appealed to the British government for further support. Parliament had passed an Act in 1732 that extended the duty-free concessions for a further nine years. In 1733 an Act was passed that also granted a government subsidy to British Arctic whalers, the first in a long series of such Acts that continued and modified the whaling subsidies throughout the 18th century. This, and the subsequent Acts, required the whalers to meet conditions regarding the crewing and equipping of the whale-ships that closely resembled the conditions suggested by Elking in 1722.[58]In spite of the extended duty-free concessions, and the prospect of real subsidies as well, the Court and Directors of the South Sea Company decided that they could not expect to make profits from Arctic whaling. They sent out no more whale-ships after the loss-making 1732 season.

Government debt after the Seven Years' War[edit]

The company continued its trade (when not interrupted by war) until the end of the Seven Years' War (1756–1763). However, its main function was always managing government debt, rather than trading with the Spanish colonies. The South Sea Company continued its management of the part of the National Debt until it was disestablished in 1853, at which point the debt was reconsolidated. The debt was not paid off by World War I, at which point it was consolidated again, under terms that allowed the government to avoid repaying the principal.

Armorials[edit]

The armorials of the South Sea Company, according to a grant of arms dated 31 October 1711, were: Azure, a globe whereon are represented the Straits of Magellan and Cape Horn all proper and in sinister chief point two herrings haurient in saltire argent crowned or, in a canton the united arms of Great Britain. Crest: A ship of three masts in full sail. Supporters, dexter: The emblematic figure of Britannia, with the shield, lance etc all proper; sinister: A fisherman completely clothed, with cap boots fishing net etc and in his hand a string of fish, all proper.[59]

Officers of the South Sea Company[edit]

The South Sea Company had a governor (generally an honorary position); a subgovernor; a deputy governor and 30 directors (reduced in 1753 to 21).[60]

| Year | Governor | Subgovernor | Deputy Governor |

|---|---|---|---|

| July 1711 | Robert Harley, 1st Earl of Oxford | Sir James Bateman | Samuel Ongley |

| August 1712 | Sir Ambrose Crowley | ||

| October 1713 | Samuel Shepheard | ||

| February 1715 | George, Prince of Wales | ||

| February 1718 | King George I | ||

| November 1718 | John Fellows | ||

| February 1719 | Charles Joye | ||

| February 1721 | Sir John Eyles, Bt | John Rudge | |

| July 1727 | King George II | ||

| February 1730 | John Hanbury | ||

| February 1733 | Sir Richard Hopkins | John Bristow | |

| February 1735 | Peter Burrell | ||

| March 1756 | John Bristow | John Philipson | |

| February 1756 | Lewis Way | ||

| January 1760 | King George III | ||

| February 1763 | Lewis Way | Richard Jackson | |

| March 1768 | Thomas Coventry | ||

| January 1771 | Thomas Coventry | vacant (?) | |

| January 1772 | John Warde | ||

| March 1775 | Samuel Salt | ||

| January 1793 | Benjamin Way | Robert Dorrell | |

| February 1802 | Peter Pierson | ||

| February 1808 | Charles Bosanquet | Benjamin Harrison | |

| 1820 | King George IV | ||

| January 1826 | Sir Robert Baker | ||

| 1830 | King William IV | ||

| July 1837 | Queen Victoria | ||

| January 1838 | Charles Franks | Thomas Vigne |

In fiction[edit]

- David Liss' historical-mystery novel A Conspiracy of Paper, set in 1720 London, is focused on the South Sea Company at the top of its power, its fierce rivalry with the Bank of England and the events leading up to the collapse of the "bubble".

- Charles Dickens novels are littered with stock-market speculations, villains, swindlers and fictional speculators:

- Nicholas Nickleby (1839) – Ralph Nickleby's great Joint Stock Company, United Metropolitan Improved Hot Muffin and Crumpet Baking and Punctual Delivery Company.

- Martin Chuzzlewit (1844) – Anglo-Bengalee Disinterested Loan and Life Company, modeled loosely on the South Sea Bubble, is in essence a classic Ponzi scheme.

- David Copperfield (1850) – The false accounting by the sycophant Uriah Heep, clerk to lawyer Mr Wickfield.

- Little Dorrit (1857) – The financial house of Mr Merdle.

- Robert Goddard's novel Sea Change (2000) covers the aftermath of the "bubble" and the attempts by politicians to evade responsibility and prevent a Jacobite restoration.

See also[edit]

- List of stock market crashes

- SSC Coinage

- Tulip mania

- History of company law in the United Kingdom

- Whaling in the United Kingdom

- Mississippi Bubble

Notes[edit]

- ^ Thornbury, Walter, Old and New London, Vol.1, p.538

- ^ "Cloth Seal, Company, 1711–1853, South Seas & Fisheries". www.bagseals.org.

- ^ Journals of the House of Commons, volume 16, 1708-1711, p. 685.

- ^ a b c Paul, Helen. "The South Sea Company's slaving activities" (PDF). Discussion Papers in Economics and Econometrics. ISSN 0966-4246.

- ^ Dorothy Marshall, (1962) Eighteenth Century England pp 121-30.

- ^ Helen Paul, (2013) The South Sea Bubble: An Economic History of its Origins and Consequences ch 4.

- ^ Walter Thornbury. 'Threadneedle Street', Old and New London: Volume 1 (London, 1878), pp. 531-544 via British History Online (accessed 21 July 2016).

- ^ Carswell p.40, 48-50

- ^ Carswell p. 50-51

- ^ a b Carswell p.52-54

- ^ Carswell p.54-55

- ^ Defoe, Daniel, An Essay on the South-Sea Trade ... , 2nd ed., (London, England: J. Baker, 1712), pp. 40-41.

- ^ Carswell p. 56

- ^ Carswell p.57,58

- ^ Carswell p.60-63

- ^ Carswell p. 64-66

- ^ Carswell p. 65-66

- ^ Carswell p. 67

- ^ Carswell p. 66-67

- ^ Carswell p.67-70

- ^ Carswell p.73-75

- ^ Carswell p.75-76

- ^ Carswell p.88-89

- ^ Carswell p.89-90

- ^ Carswell p.100-102

- ^ a b Carswell p.102-107

- ^ http://www.ukpublicspending.co.uk/budget_pie_ukgs.php?span=ukgs302&year=1717&view=1&expand=&units=b&fy=2010&state=UK#ukgs302

- ^ Carswell p.112-113

- ^ Carswell p.114-118

- ^ Cowles, ch. II, IV (esp. pp. 151, 168–169 for share prices)

- ^ Cowles, ch. IV

- ^ Cowles, ch. IV (esp. p. 146 for bribe shares)

- ^ a b Carswell p.116-117

- ^ Carswell p.138-140

- ^ Paul, Helen Julia (2010) The South Sea Bubble: an economic history of its origins and consequences, Routledge Explorations in Economic History, Routledge, London.

- ^ Odlyzko, Andrew. "An undertaking of great advantage, but nobody to know what it is: Bubbles and gullibility" (PDF). University of Minnesota. Retrieved 22 October 2020.

- ^ Alter, Peter (2018). "Der geplatzte Traum vom schnellen Geld". Damals (in German). Vol. 50 no. 8. pp. 72–76.

- ^ Marshall, pp 127-30.

- ^ Richard A. Kleer, "Riding a wave: the Company’s role in the South Sea Bubble" (2015) p 165.

- ^ Stephen Taylor, "Walpole, Robert, first earl of Orford (1676–1745)", Oxford Dictionary of National Biography (2008)

- ^ Spence, Anecdotes, 1820, p. 368.

- ^ John O'Farrell, An Utterly Impartial History of Britain – Or 2000 Years of Upper Class Idiots In Charge (October 22, 2007) (2007, Doubleday, ISBN 978-0-385-61198-5)

- ^ Richard S. Westfall (1983). Never at Rest: A Biography of Isaac Newton. Cambridge UP. pp. 861–62. ISBN 9780521274357.

- ^ Holodny, Elena. “Isaac Newton Was a Genius, but Even He Lost Millions in the Stock Market.” Business Insider, Business Insider, 10 Nov. 2017, www.businessinsider.com/isaac-newton-lost-a-fortune-on-englands-hottest-stock-2016-1.

- ^ Nelson (1945) states that the substantial illicit trade pursued by the South Sea Company officials under the Asiento “must be considered as a major cause of the War of Jenkins' Ear because it threatened to destroy the entire commercial framework of the Spanish Empire ... Unable to accept the destruction of its commercial system, Spain attempted to negotiate but requested that the company, as an evidence of good faith, should open its accounts for inspection by the Spanish representatives. Naturally, the directors refused, for compliance would have meant the complete exposure of the illegal traffic. Neither Spain nor the South Sea Company would yield. War was the inevitable result”.

- ^ Brown (1926, p. 663) says that The failure to comply with the accounting provisions of the Asiento treaty (in the context of Spanish knowledge of secret accounts kept by the South Sea Company which would prove clandestine trading) was a constant source of the friction which culminated in armed conflict.

- ^ For Hildner (1938), the war of 1739 might have been averted if the issues addressed by the commission established in 1732 to settle disputes over the Asiento had been resolved.

- ^ "History Cooperative – A Short History of Nearly Everything!". History Cooperative. Archived from the original on 2009-10-20.

- ^ Paul, Helen. "The South Sea Company's slaving activities". Archived from the original on 2012-12-09.

- ^ Paul, H.J. (2010). The South Sea Bubble.

- ^ Walker, G. J. (1979), p. 101

- ^ Archivo General de Indias, Seville, Spain IG2785

- ^ McLachlan, (1940), pp. 130-131

- ^ Archivo General de Indias, Seville, Spain C266L3

- ^ Elking, Henry [1722](1980). A view of the Greenland Trade and whale-fishery. Reprinted: Whitby: Caedmon. ISBN 0-905355-13-X

- ^ Zacchi, Uwe (1986). Menschen von Föhr. Lebenswege aus drei Jahrhunderten (in German). Heide: Boyens & Co. p. 13. ISBN 978-3-8042-0359-4.

- ^ Anderson, Adam [1801](1967). The Origin of Commerce. Reprinted: New York: Kelley.

- ^ Evans, Martin H. (2005). Statutory requirements regarding surgeons on British whale-ships. The Mariner's Mirror 91 (1) 7-12.

- ^ National Maritime Museum, Greenwich, catalogue entry for sculpture of arms, object ID: HRA0043 [1]

- ^ See, for 1711–21, J Carswell, South Sea Bubble (1960) 274-9; and for 1721–1840, see British Library, Add. MSS, 25544-9.

References[edit]

- Historical

- Brown, V.L. (1926), "The South Sea Company and Contraband Trade", The American Historical Review, 31 (4): 662–678, doi:10.2307/1840061, JSTOR 1840061

- Carlos, Ann M. and Neal, Larry. (2006) "The Micro-Foundations of the Early London Capital Market: Bank of England shareholders during and after the South Sea Bubble, 1720–25" Economic History Review 59 (2006), pp. 498–538. online

- Carswell, John (1960), The South Sea Bubble, London: Cresset Press

- Cowles, Virginia (1960), The Great Swindle: The Story of the South Sea Bubble, New York: Harper

- Dale, Richard S.; et al. (2005), "Financial markets can go mad: evidence of irrational behaviour during the South Sea Bubble", Economic History Review, 58 (2): 233–271, doi:10.1111/j.1468-0289.2005.00304.x, S2CID 154836178

- Dale, Richard (2004). The First Crash: Lessons from the South Sea Bubble (Princeton University Press.)

- Freeman, Mark, Robin Pearson, and James Taylor. (2013) "Law, politics and the governance of English and Scottish joint-stock companies, 1600–1850." Business History 55#4 (2013): 636-652. online

- Harris, Ron (1994). "The Bubble Act: Its Passage and its Effects on Business Organization." The Journal of Economic History, 54 (3), 610–627

- Hildner, E.G. Jr. (1938), "The Role of the South Sea Company in the Diplomacy leading to the War of Jenkins' Ear, 1729–1739", The Hispanic American Historical Review, 18 (3): 322–341, doi:10.2307/2507151, JSTOR 2507151

- Hoppit, Julian. (2002) "The Myths of the South Sea Bubble," Transactions of the Royal Historical Society, (2002) 12#1 pp 141–165 in JSTOR

- Kleer, Richard A. (2015) "Riding a wave: the Company's role in the South Sea Bubble." The Economic History Review 68.1 (2015): 264-285. online

- McLachlan, J.O. (1940), Trade and Peace With Old Spain, 1667–1750, Cambridge: Cambridge University Press

- McColloch, William E. (2013) "A shackled revolution? The Bubble Act and financial regulation in eighteenth-century England." Review of Keynesian Economics 1.3 (2013): 300-313. online

- Mackay, C. Extraordinary Popular Delusions and the Madness of Crowds (1841)

- Marshall, Dorothy. (1962) Eighteenth Century England Longman. pp 121-30.

- Michie, R.C. (2001), "From Market to Exchange, 1693–1801", The London Stock Exchange, Oxford: Oxford University Press, ISBN 978-0-19-924255-9

- Nelson, G.H. (1945), "Contraband Trade Under the Asiento", The American Historical Review, 51 (1): 55–67, doi:10.2307/1843076, JSTOR 1843076

- Paul, Helen Julia (2010) The South Sea Bubble: an economic history of its origins and consequences, Routledge Explorations in Economic History online short summary

- Paul, Helen. (2013) The South Sea Bubble: An Economic History of its Origins and Consequences Routledge, 176pp.

- Paul, Helen, The "South Sea Bubble", 1720, EGO - European History Online, Mainz: Institute of European History, 2015, retrieved: March 17, 2021 (pdf).

- Plumb, J. H. (1956) Sir Robert Walpole, vol. 1, The Making of a Statesman. ch 8

- Shea, Gary S. (2007), "Understanding financial derivatives during the South Sea Bubble: The case of the South Sea subscription shares" (PDF), Oxford Economic Papers, 59 (Supplement 1): i73–i104, doi:10.1093/oep/gpm031

- Temin, Peter; Voth, Hans-Joachim (2004), "Riding the South Sea Bubble", American Economic Review, 94 (5): 1654–1668, doi:10.1257/0002828043052268

- Stratmann, Silke (2000) Myths of Speculation: The South Sea Bubble and 18th-century English Literature. Munich: Fink

- Walker, G.J. (1979), Política Española y Comercio Colonial 1700–1789, Barcelona: Editorial Ariel

- Fiction

- Liss, David (2000), A Conspiracy of Paper, New York: Random House, ISBN 978-0-375-50292-7. Novel set around the South Sea Company bubble.

- Goddard, Robert (2000), Sea Change, London: Bantam Press, p. 416, ISBN 978-0-593-04667-8. Novel set against the background of the South Sea bubble.

External links[edit]

| Wikimedia Commons has media related to South Sea Bubble. |

| Wikisource has the text of the 1911 Encyclopædia Britannica article South Sea Bubble . |

- Quotations related to South Sea Company at Wikiquote

- South Sea Bubble collection at Harvard University

- Famous First Bubbles – South Sea Bubble

- Charles McKay's Account of The South Sea Bubble in Modern English at the Wayback Machine (archived January 6, 2014)

- Helen Paul's Account of The South Sea Company's slave trading activities at archive.today (archived 2012-12-09)

- The South Sea Bubble, audio programming with Melvyn Bragg and guests, BBC Radio 4.

.jpg/440px-Microcosm_of_London_Plate_101_-_South_Sea_House,_Dividend_Hall_(tone).jpg)